2017 Q2 tax calendar: Key deadlines for businesses and other employers

Here are some of the key tax-related deadlines affecting businesses and other employers during the second quarter of 2017. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact Louis LoBue at l.lobue@twru.com or 225-926-1050 to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. April 18 If a calendar-year C corporation, file a 2016 income tax return (Form 1120) or file for an automatic six-month extension (Form 7004), and pay any tax due. If the return isn’t...

Read MoreDeduct all of the mileage you’re entitled to — but not more

Rather than keeping track of the actual cost of operating a vehicle, employees and self-employed taxpayers can use a standard mileage rate to compute their deduction related to using a vehicle for business. But you might also be able to deduct miles driven for other purposes, including medical, moving and charitable purposes. What are the deduction rates? The rates vary depending on the purpose and the year: Business: 54 cents (2016), 53.5 cents (2017) Medical: 19 cents (2016), 17 cents (2017) Moving: 19 cents (2016), 17 cents (2017) Charitable: 14...

Read MoreBe aware of the ins and outs of holding joint title to property

Owning assets jointly with one or more children or other heirs is a common estate planning “shortcut.” But like many shortcuts, it can produce unintended — and costly — consequences. Advantages There are two potential advantages to joint ownership: convenience and probate avoidance. If you hold title to property with a child as joint tenants with “right of survivorship,” when you die, the property is transferred to your child automatically. You don’t need a trust or other estate planning vehicles and it’s not necessary to go through probate. Disadvantages Joint...

Read MoreThe tax-smart way to replace a business vehicle

Although a vehicle’s value typically drops fairly rapidly, the tax rules limit the amount of annual depreciation that can be claimed on most cars and light trucks. Thus, when it’s time to replace a vehicle used in business, it’s not unusual for its tax basis to be higher than its value. This can be costly tax-wise, depending on how you dispose of the vehicle: Trade-in. If you trade a vehicle in on a new one, the undepreciated basis of the old vehicle simply tacks onto the basis of the...

Read MoreWhy nonprofits need continuity plans

Most not-for-profits are intensely focused on present needs — not the possibility that disaster will strike sometime in the distant future. Yet it’s critical that all organizations have a formal continuity plan to guide them should a natural or manmade disaster disrupt operations. Formal plan You likely already have many of the necessary processes in place — such as safely evacuating your office or backing up data. A continuity plan can help you organize and document existing processes and address any other issues you might have overlooked. If your...

Read MoreWhen an elderly parent might qualify as your dependent

It’s not uncommon for adult children to help support their aging parents. If you’re in this position, you might qualify for the adult-dependent exemption. It allows eligible taxpayers to deduct up to $4,050 for each adult dependent claimed on their 2016 tax return. Basic qualifications For you to qualify for the adult-dependent exemption, in most cases your parent must have less gross income for the tax year than the exemption amount. (Exceptions may apply if your parent is permanently and totally disabled.) Generally Social Security is excluded, but payments from...

Read More

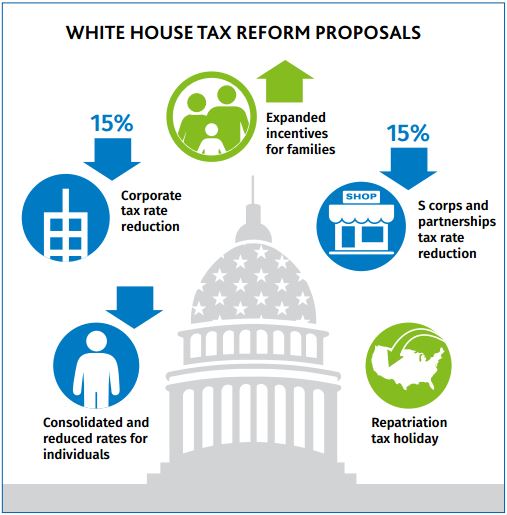

Administration’s 2017 Tax Reform Outline

Updated: April 27, 2017Original Article by CCHgroup.com President Trump has unveiled a tax reform outline –the "2017 Tax Reform for Economic Growth and American Jobs." The outline calls for dramatic tax cuts and simplification: lower individual tax rates under a three-bracket structure, doubling the standard deduction, and more than halving the corporate tax rate; along with changing the tax treatment of pass-throughs, expanding child and dependent incentives, and more. Both the alternative minimum tax and the federal estate tax would be eliminated. The White House proposal does not include spending...

Read MorePTO banks: A smart HR solution for many companies

“I’m taking a sick day!” This familiar refrain usually is uttered with just cause, but not always. What if there were no sick days? No, we’re not suggesting employees be forced to work when they’re under the weather. Rather, many businesses are adopting a different paradigm when it comes to paid time off (PTO). Under the “PTO bank” concept, employers merge most (or all) of the traditional components of excused absences (vacation time, sick time, personal days and so on) into one simple employee-managed account, typically offering not quite...

Read MoreWhat can a valuation expert do for your succession plan?

Most business owners spend a lifetime building their business. And when it comes to succession, they face the difficult decision of whether to sell, dissolve or transfer the business to family members (or a nonfamily successor). Many complicated issues are involved, including how to divvy up business interests, allocate value and tackle complex tax issues. Thus, as you put together your succession plan, include not only your financial and legal advisors, but also a qualified valuation professional. Various value factors When drafting a succession plan, a valuation expert can...

Read MoreUse qualified auditors for your employee benefit plans

Employee benefit plans with 100 or more participants must generally provide an audit report when filing IRS Form 5500 each year. Plan administrators have fiduciary responsibilities to hire independent qualified public accountants to perform quality audits. Select a qualified auditor ERISA guidelines require employee benefit plan auditors to be licensed or certified public accountants. They also require auditors to be independent. In other words, they can’t have a financial interest in the plan or the plan sponsor that would bias their opinion about a plan’s financial condition. But specialization...

Read More