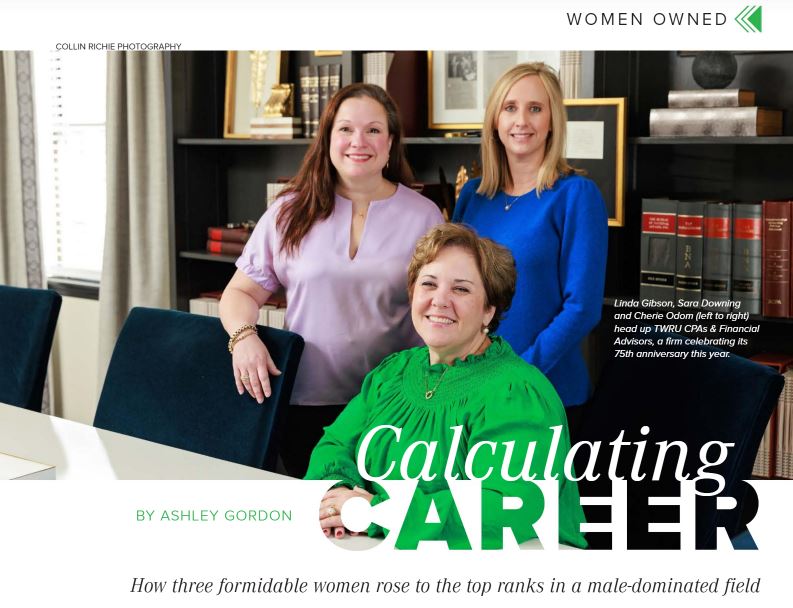

Business Report Celebrates TWRU’s 75-Year Anniversary

TWRU is celebrating 75 years in business, and Business Report took note. Business Report has previously featured TWRU for its “family first” approach to business. This time is no different, with TWRU attributing its longevity and staying power in the CPA and financial advising business. The report also details the history of the full-service accounting firm and explains the origins of the company’s name, stemming from the names of the founders and early managers. Read the full article below. TWRU 75th Anniversary

Read More

TWRU Featured in 5th & Main Magazine

TWRU and it three partners are recognized in 5th and Main Magazine for owning a successful business with a family-friendly culture that includes both employees and clients. 5th & Main Magazine is published twice a year by Louisiana Business & Industry, LABI. Read the entire article here.

Read More

‘Family first’ philosophy drives firm’s success

As seen in Baton Rouge Business Report WHILE MANY BUSINESSES are pondering how to keep up with employees' desires for a better work-life balance, TWRU CPAs & Financial Advisors has had a family-first mentality since its start in 1948, which has resulted in more fulfilled employees producing a better product. The firm that was started by Edgar Thomas has grown over the last 70 years to its place among the top five accounting firms in the area. With its main office in Baton Rouge, at 527 East Airport Avenue, TWRU...

Read More

Automating your accounting department

Many businesses have adopted robotic process automation (RPA), or plan to do so in the future. While most RPA initiatives target “core” business operations, routine accounting functions also can be automated to help lower costs and allow personnel to focus on higher-level analyses and strategic projects. Here’s some insight into how to integrate RPA in your accounting department. Paving the wayIn general, RPA eliminates the need for manual (human) intervention. In the accounting department, automation software can assume control of such tasks as journal entries, bank reconciliations, and certain aspects...

Read More

The home office deduction: Actual expenses vs. the simplified method

If you run your business from your home or perform certain functions at home that are related to your business, you might be able to claim a home office deduction against your business income on your 2018 income tax return. Thanks to a tax law change back in 2013, there are now two methods for claiming this deduction: the actual expenses method and the simplified method. Basics of the deductionIn general, you’ll qualify for a home office deduction if part of your home is used “regularly and exclusively” as your...

Read More

Why you shouldn’t wait to file your 2018 income tax return

The IRS opened the 2018 income tax return filing season on January 28. Even if you typically don’t file until much closer to the April 15 deadline, this year consider filing as soon as you can. Why? You can potentially protect yourself from tax identity theft — and reap other benefits, too. What is tax identity theft?In a tax identity theft scheme, a thief uses your personal information to file a fraudulent tax return early in the tax filing season and claim a bogus refund. You discover the fraud when...

Read More

Why you shouldn’t wait to file your 2018 income tax return

The IRS opened the 2018 income tax return filing season on January 28. Even if you typically don’t file until much closer to the April 15 deadline, this year consider filing as soon as you can. Why? You can potentially protect yourself from tax identity theft — and reap other benefits, too. What is tax identity theft? In a tax identity theft scheme, a thief uses your personal information to file a fraudulent tax return early in the tax filing season and claim a bogus refund. You discover the fraud...

Read More

IRS issues guidance to ease transition to FASB’s new revenue recognition rule

In 2014, a new accounting standard on how to recognize revenue from contracts was issued by the Financial Accounting Standards Board (FASB). Now the IRS is allowing a new automatic change in accounting method for businesses to use to conform with the new financial accounting standard. This will allow for more book-tax conformity and facilitate accounting method change requests associated with adopting the new standard. New accounting rules Accounting Standards Update (ASU) No. 2014-09, Revenue from Contracts with Customers, goes into effect in 2018 for public companies and 2019 for...

Read More

Provide for your spouse, then your kids, with a QTIP trust

If you want to preserve as much wealth as possible for your children, but you leave property to your spouse outright, there’s no guarantee your objective will be met. This may be a concern if your spouse has poor money management skills or if you two don’t see eye to eye on how assets should be distributed to your children. In both of these situations, a properly designed qualified terminable interest property (QTIP) trust may be the answer. How does it work? A QTIP trust provides your spouse with income...

Read More

Your original will: Does your family know where to locate it?

In a world that’s increasingly paperless, you’re likely becoming accustomed to conducting a variety of transactions digitally. But when it comes to your last will and testament, only an original, signed document will do. A photocopy isn’t good enough Many people mistakenly believe that a photocopy of a signed will is sufficient. In fact, most states require that a deceased’s original will be filed with the county clerk and, if probate is necessary, presented to the probate court. If your family or executor can’t find your original will, there’s a...

Read More